2.9.4.1. Conversion Ratios

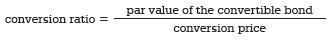

The number of shares of stock that a bondholder will receive upon converting a bond is called the conversion ratio and is specified in the indenture. Conversion ratios are set to reflect some price above the price of the company’s stock at the time of the bond’s issuance. Let’s assume the conversion price was set at $20. The formula to calculate a conversion ratio is as follows:

Thus, the conversion ratio would be 50 ($1,000 / $20), meaning the investor would receive 50 shares for converting one bond.

If the stock was selling at $24 per share and the bondholder decided to convert, the bondholder would receive 50 shares of stock that would be worth $24 (stock price) x 50 (con